ABC Self Assessment were founded back in 2013, with a development team claiming over 40 years of experience. Unlike some competitors, that have their roots in the commercial sector to cater to professional accountants and financial professionals, ABC Self Assessment has focused on individuals interested in doing their own tax returns.

ABC Self Assessment was first recognized by HRMC in 2014, and the team regularly meets with HRMC to be kept abreast of upcoming changes to the tax landscape. They also contribute to the HRMC’s planned next step, the Making Tax Digital initiative. It's tax and accountancy software that sits alongside the likes of competitors FreshBooks, QuickBooks, Xero, Sage Business Cloud Accounting, Kashoo, Zoho Books and Kashflow.

- Want to try ABC Self Assessment? Check out the website here

Pricing

ABC Self Assessment does keep things simple, eschewing a pile of complicated tiers in favor of a simplified, and affordable approach. Each purchase is based on an activation key that allows for a single submission, and necessary amendments for a single tax year.

The plan starts with the ABC SA100 For Individuals at a cost of £15 plus VAT. Included in the price is the submission to the HRMC. There is the option of a browser based web version, or via downloaded software. Rather than offering a less than complete package, ABC Self Assessment covers the full gamut of tax situations that an individual is likely to encounter and includes the basic SA100 form, as well the following supplementary forms:

- Employments (SA102, full and short versions)

- Ministers of Religion (SA102M)

- Self Employment (SA103, full and short versions)

- Partnership (SA104, full and short versions)

- UK Property (SA105)

- Foreign (SA106) (note: not available in the 2014-15 version)

- Trusts etc. (SA107)

- Capital Gains (SA108)

- Residence, remittance etc. (SA109)

- Supplementary information (SA101)

- Tax calculation summary (SA110)

The list covers most tax situations, but there are a few more advanced, and less than common scenarios lacking, such as Lloyd's Underwriters (SA103L), multiple chargeable event gains, and disclosures regarding the Swiss/UK Tax Cooperation Agreement. In addition, those individuals with Capital Gains Tax may need to do some manual calculations and detail on an attachment.

ABC Self Assessment has bundle deals too, which include two ABC SA 100s for £27 plus VAT that saves you 10% or a combination of one ABC SA800 and two ABC SA100s for £45 plus VAT that also saves 10%.

There is also the option to purchase the software for previous years, back until the 2014 to 2015 tax year, which are the same price as the current version. There are bulk discounts available for folks that need to file multiple returns. For example, two returns costs £27 plus VAT.

The only other option is for the ABC SA800 (for partnerships), which has a cost of £20 plus VAT per partnership. This software is used to notify the HRMC of income and disposals related to a partnership.

Features

ABC Self Assessment is a bit of a throwback, as it is downloadable software, rather than a cloud based service. Further adding to this is that there are no smartphone apps. However, we like that the software can be downloaded, and fully put through the paces to ensure it suits your tax situation, and only when you are done and ready to submit the taxes, the user then purchases their activation key for a true ‘Try before you buy’ option.

While it is possible to use the HRMC directly to do the taxes, ABC Self Assessment promises a better experience. It is designed for the more ‘taxing’ situations such as UK taxpayers living overseas, individuals with income from a trust, and ministers of religion. It does this by providing supplementary forms that are used to detail income from sources other than income, including property, savings or investments.

The problem stems from that the HRMC website asks all users the same complete set of questions. This becomes tedious, as users end up having to answer many questions that do not apply to their individual tax situation. ABC Self Assessment streamlines the process, tailoring the questions based on responses to only those that are relevant, saving the user time.

To maintain accuracy, the questions are presented “in an almost identical manner” to the HRMC paper forms. The inquiries begin with the basic demographic information, including your National Insurance number, and the Unique Tax Reference (UTR). We appreciate the Autosave function of the program to ensure no data is lost along the way.

Options are available for support. There is a general Frequently Asked Questions, that covers common issues such as activating the software, or how to save data. For specific queries, they are emailed via a ‘Contact Us’ form. The emails are only answered from 9:00 am to 5:00 pm on weekdays, so don’t wait until the last minute, with additional coverage during ‘crunch time’ in January. A limitation of the program is that it lacks an option for phone support.

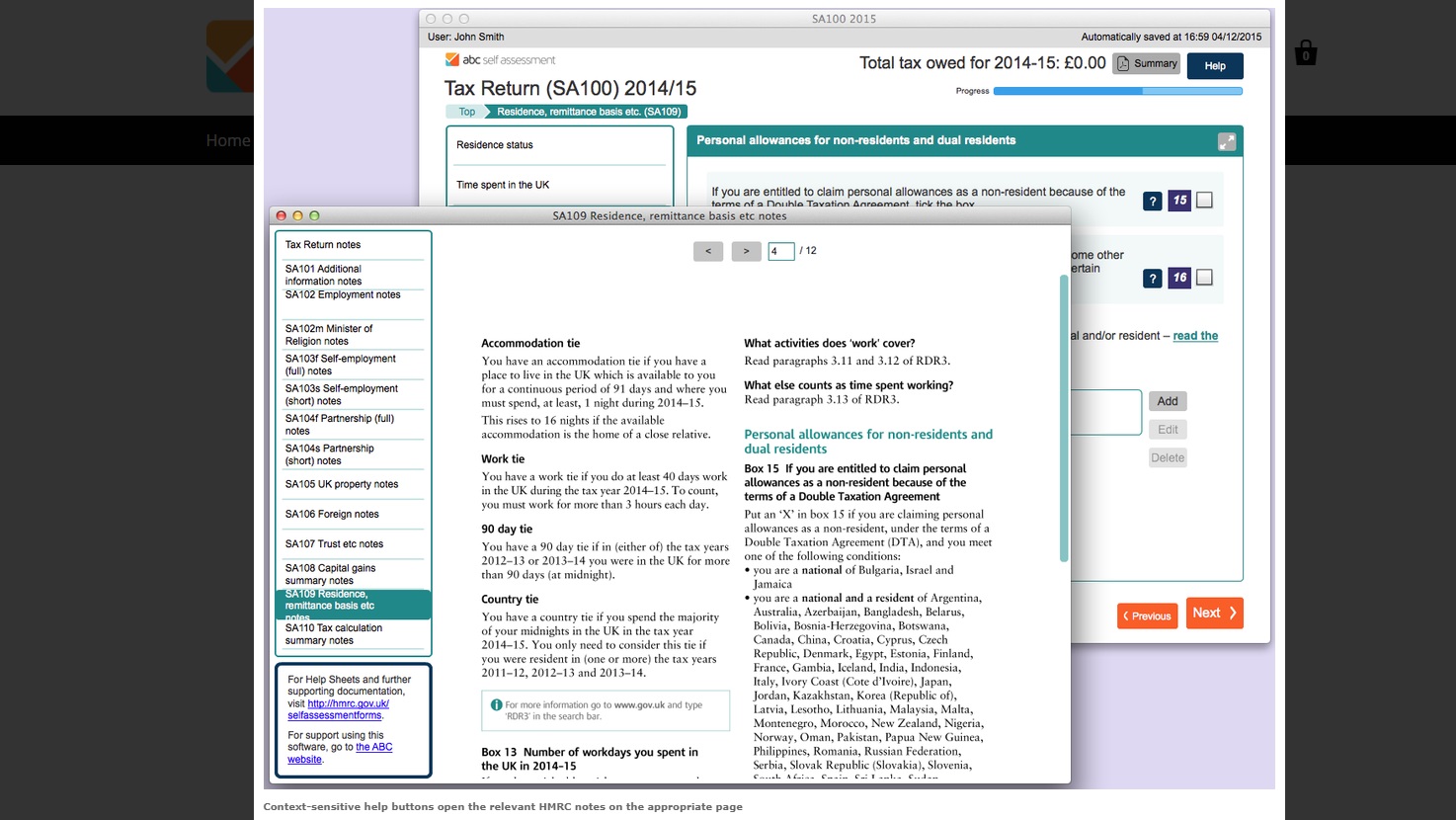

While help is certainly available, for the most part you will not even need it. When faced with a question, ABC Self Assessment has loads of ‘Just in time’ education, as context sensitive help comes to the rescue, and pops right up.

Some software does not calculate the tax until the entire return is completed. However, ABC Self Assessment gives a running ‘Total tax owed,’ so the user is not surprised at the end with a tax payment that would be a strain on short notice.

Final verdict

ABC Self Assessment keeps doing your taxes affordable, if not downright cheap. We appreciate the simplified approach of a single tier for individuals, with just another tier for partnerships, and having that covers just about all the common forms that folks would need. While it does not have mobile apps, or integration with accounting software, for many tax filers, this should suit their needs just fine.

- We've also highlighted the best tax software

from TechRadar - All the latest technology news https://ift.tt/3hvLrA1

via IFTTT

0 التعليقات: